On-chain and off-chain storage¶

Any Product on the DIP has a choice of:

- what type of data to store

- where to store data

The DIP storage model allows products contracts to store its data on:

- blockchain smart contracts

- a platform database

- a product database

Note

Payment card data should be stored on a payment provider level as it requires PCI compliance to store payment card data of customers in a database.

In many countries, a legal agreement is needed between a party that runs a storage service and a party that uses a storage service.

On-chain¶

As the DIP operates in the Ethereum environment, the term on-chain specifies smart contracts, where a product can store risk description and specific metadata per policy.

The key principle of how the DIP itself uses data is that no personal data is kept in smart contracts — only unique hashed references.

The DIP allows to store data for any product regarding its:

- customers (Note: first_name, last_name, and e-mail fields are required by the GIF.)

- policies

- claims

In case a product doesn’t want to use a platform database, it is possible to use the product’s database.

Attention

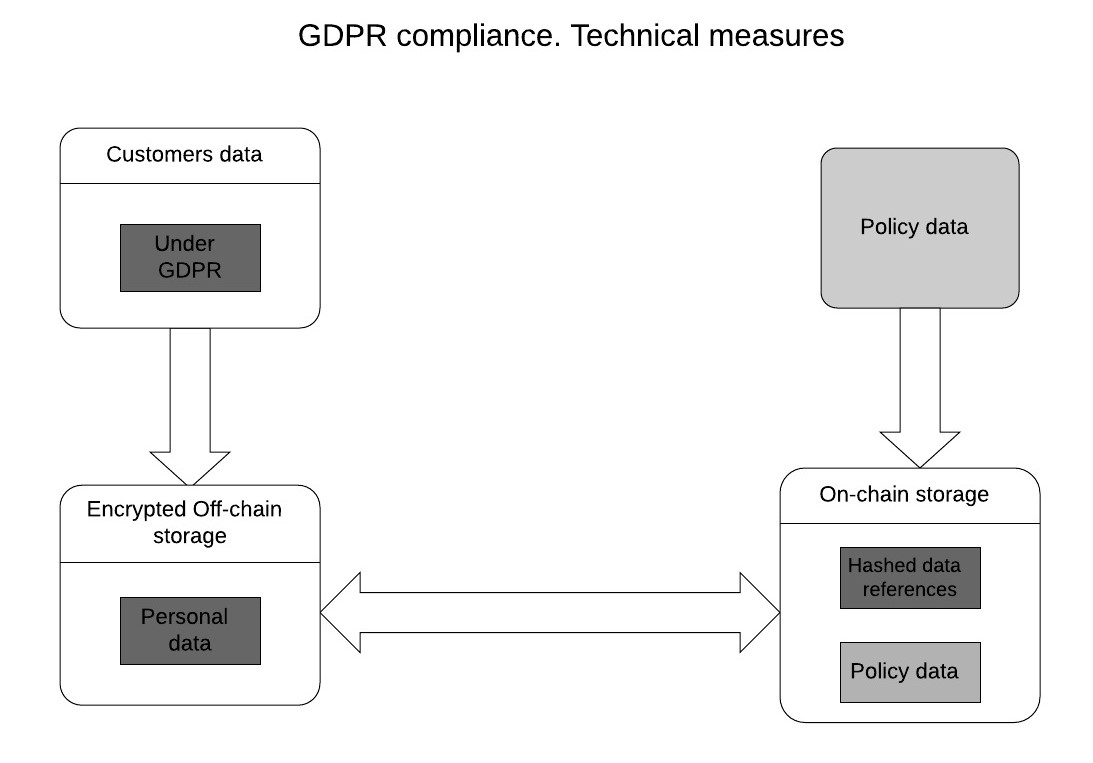

According to the EU General Data Protection Regulation requirements, we prevent you from storing personal data of customers on-chain. This data is to be stored off-chain only. There exist special identificators stored on-chain (hashed data references), which allow for retrieving data from an off-chain database. This prevents unauthorized access to sensitive data by an on-chain identificator. The diagram below illustrates the relations between on-chain and off-chain storage. This methodology implements the “Positionspapier des Bundesblock,” the german association of blockchain companies which tries to implement this methodology in EU law.

Profiling¶

To avoid the possibility of the so-called customer “profiling,” each newly issued policy gets a new unique customer ID (unique hashed reference).

Make Payouts¶

In order to make payouts in fiat money, a product contract needs to use the GIF Payout microservice.

Your product App (here we mean a server App body of your product that connects and coordinates its on-chain and off-chain parts) needs to subscribe to the Event Listener microservice to get notifications about the off-chain events related to your product. This way, the product App knows that a new entity “Payout” appears with the “expected” state. To make a payout, a product contract should send a message to the framework with the following structure:

{

id: 'payout',

type: 'object',

properties: {

policyId: { type: 'string' },

payoutAmount: { type: 'number' },

currency: { type: 'string' },

provider: { type: 'string' },

contractPayoutId: { type: 'string' },

},

Where the ‘policyId’, ‘payoutAmount’, ‘currency’, ‘provider’, and ‘contractPayoutId’ attributes are required to be defined.

The product contract sends the above-mentioned message to the Payout microservice. The information should contain the address where payout funds are to be transferred and the transfer method (e.g., transfer to a bank account, payment card, a transferwise, PayPal account, coin wallet, post transfer, etc.).

Below, you can find an example of a payout message (referred to a particular policy, with ID equal to 1) made by the Payout microservice (“Transferwise”). The payout is made in fiat money (100 EUR) and a product contract is to be notified about this.

1 2 3 4 5 6 | {

policyId: 1,

payoutAmount: 100,

currency: 'EUR',

provider: 'transferwise',

}

|

To describe the process in more detail, we provide the following clarification of the interaction between the GIF and product components during the payout process.

There are a few entities involved in the process of payout: the product smart contract, the product App, the ProductService contract, the Policy module and some microservices (such as Event Listener, Payout microservice and Ethereum signer).

The process starts with confirming a claim by calling the _confirmClaim function in the product contract. This function is addressed to the ProductService contract, which delegates it to the Policy module. The function is performed here and an entity “Claim” changes its state to “Confirmed”.

At the same time, a new entity “Payout” is created at the Policy module with the “expected” state. When the states are changed, the LogPayoutStateChanged event takes place. This event, like many other events, is “listened” by a particular microservice — Event Listener subscribed to the events of the core contract.

Then, Event Listener notifies the product App (with a business logic implemented) about this event. This App exchanges messages with other microservices involved (the Payout microservice and the Ethereum signer microservice) in order to make a payout. The Ethereum signer microservice can make payouts on the Ethereum blockchain. It also notifies the product contract, which calls the _confirmPayout function and addresses it to the ProductService contract.

This results to a similar flow (ProductService — Policy module — the payout changes state to “Paid out” — the LogPayoutStateChanged event occurs — Event Listener notifies the product App — the product App orders the Notification microservice to notify the customer about the payout — the Notification microservice sends a message to the customer and reports about it to the product App).